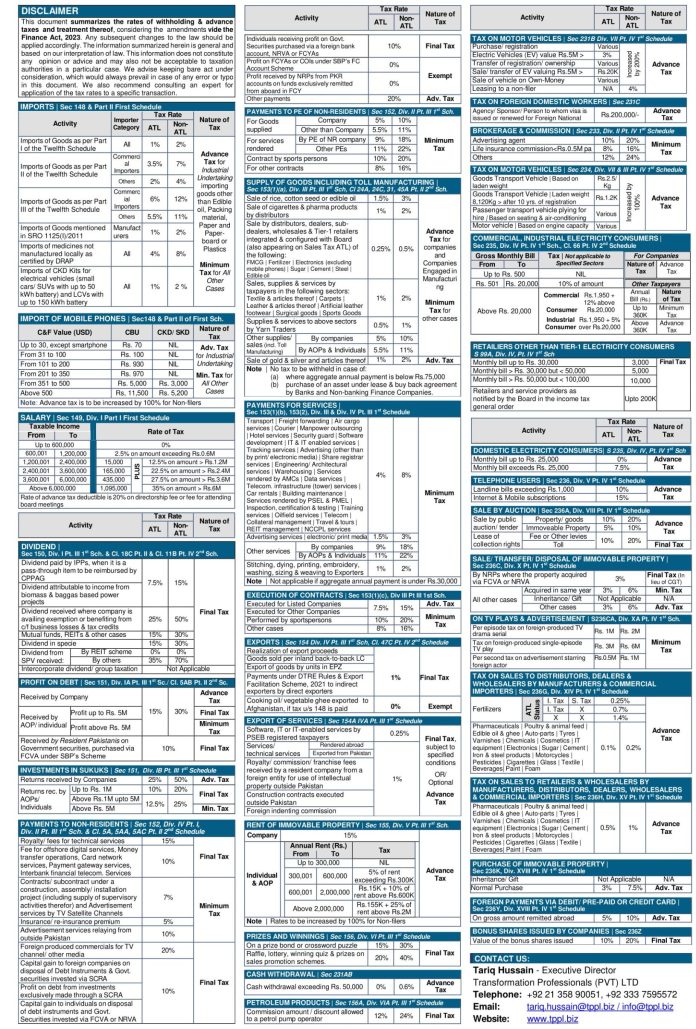

Withholding Tax New Rates on Venders Supplies, Services 2024-2025: Here You can get the Latest Withholding Tax Rate for Vendors who provide supplies, Services, and Transportation. All rates implement on fillers and nonfilers vendors or individuals.

Withholding tax is a tax deducted at source from certain types of payments in Pakistan. It is a mechanism through which the government collects tax from individuals or entities making payments to others. The person or entity making the payment deducts the tax from the payment amount and remits it to the tax authorities on behalf of the recipient.

In Pakistan, withholding tax is governed by the Income Tax Ordinance, 2001, and the rules issued by the Federal Board of Revenue (FBR). The FBR is the apex tax authority in Pakistan responsible for the administration and enforcement of tax laws.

Withholding Tax New Rates on Venders Supplies, Services 2024-2025

Withholding tax is applicable to various types of payments, including:

- Salary and wages: Employers are required to deduct tax from the salary and wages paid to their employees.

- Dividends: Companies are required to deduct tax at a prescribed rate from dividends distributed to their shareholders.

- Rent: Withholding tax is applicable on rent payments exceeding a specified threshold. The rate varies depending on the type of property and the status of the recipient.

- Contracts and services: Withholding tax is applicable on payments made for contracts, services, or technical fees. The rate varies depending on the nature of the payment and the status of the recipient.

- Royalties: Payments made as royalties for the use of intellectual property rights are subject to withholding tax.

- Banking transactions: Certain banking transactions, such as cash withdrawals or cross-border remittances, may be subject to withholding tax.

The rates of withholding tax vary depending on the type of payment and the tax status of the recipient. The FBR issues updated withholding tax rates and guidelines each year through its notifications and circulars.

It’s important to note that withholding tax is not the final tax liability of the recipient. The recipient can claim credit for the tax withheld against their final tax liability when filing their income tax return.

Please keep in mind that tax laws and regulations can change over time, so it’s always a good idea to consult with a tax professional or refer to the latest information from the FBR to ensure compliance with the current rules and rates of withholding tax in Pakistan.