Income Tax on Salary Income 2025: The government of Pakistan proposed income tax 2025-2026 in the budget 2025-2026. Ishaq Dar presented a budget briefing. The budget for the fiscal year 2025 was mixed for the white-collar income group as the government lowered tax rates and the number of plates but removed the available provision of credit by eliminating the deductible profit-on-debt deduction and the investment tax credit in shares, health insurance companies, and pension funds.

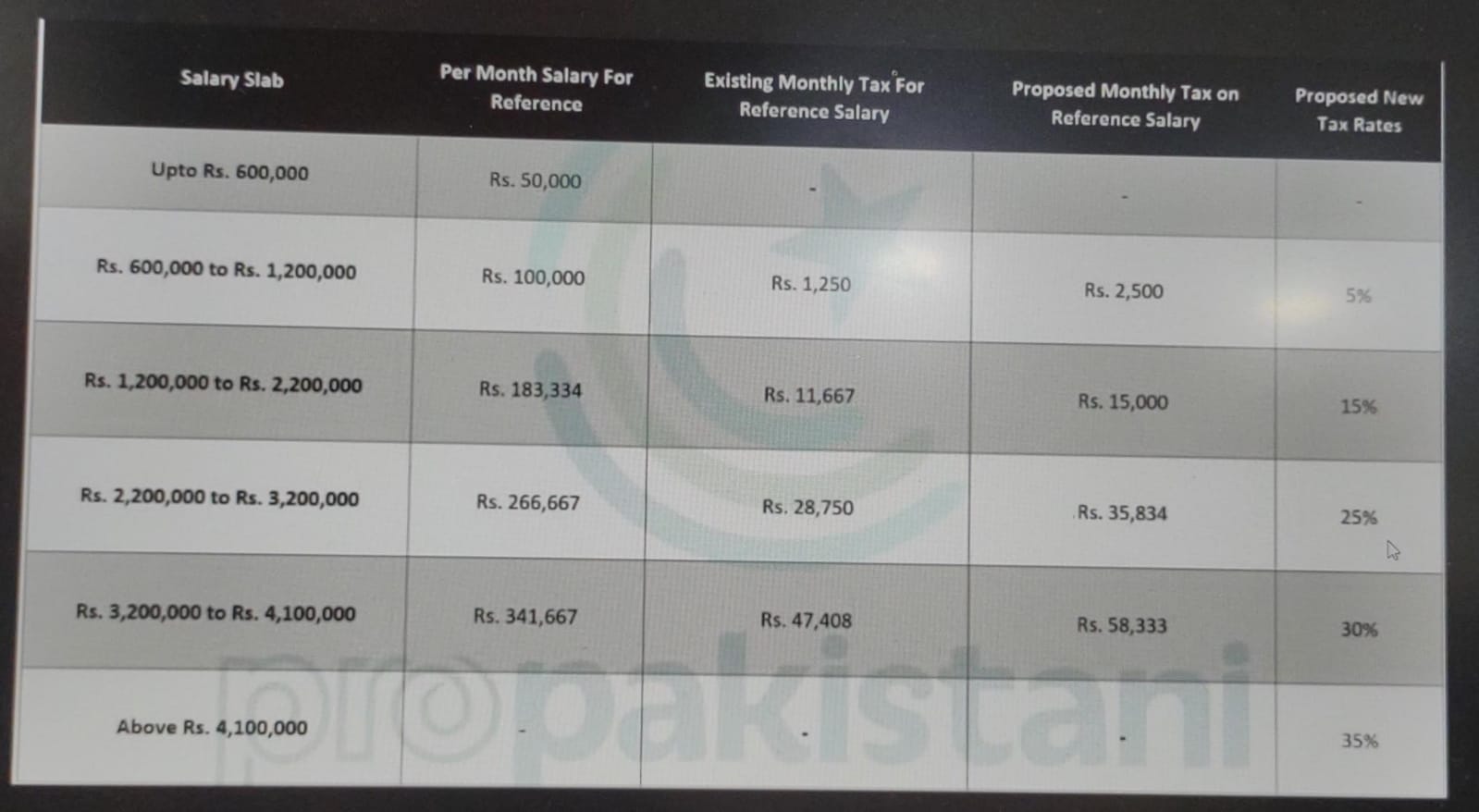

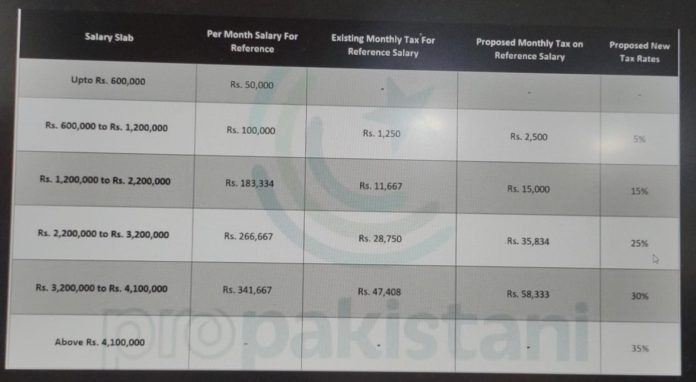

Comparison of Income Tax on Salary Income Tax Year 2025-2026

The new coalition government made changes to the income tax collection table in its first federal budget for 2025-26.

The table below details the tax rates applicable to revised income plates in Pakistan.

Income Tax Slabs 2025-2026