You can find NTN number with CNIC NO. FBR Make this so easy no need to make registration on any gov website just open the link and add CNIC and you can see company detail and NTN Number. Although Pakistanis are one of the highest Tax playing nations in the world.

The governments and concerned departments have been lacking when it comes to revenue collection. In recent times Govt. has shrunken the circle against non-filers by advancing fee structure.

Having said that, the Government of Pakistan has been simplifying the procedure for the filing income Tax. Also, it has been working for several hassles free online methods for consumers. So, it becomes easy for the end consumer to become a filer and check the statistics of the Tax he pays.

NTN Stand for?

National Tax Number (NTN) is just like your CNIC which refers to your identity. NTN is your Tax ID. All the details of your Taxes and their payments can be accessed through your NTN. It is linked to your CNIC. Follow this simple method to find your NTN using CNIC.

FIND NTN Verification with CNIC

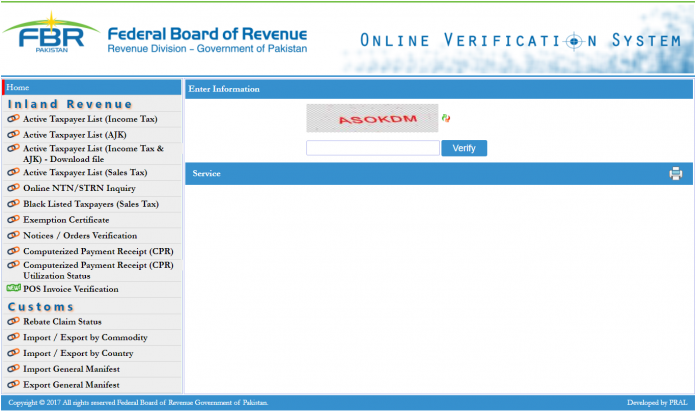

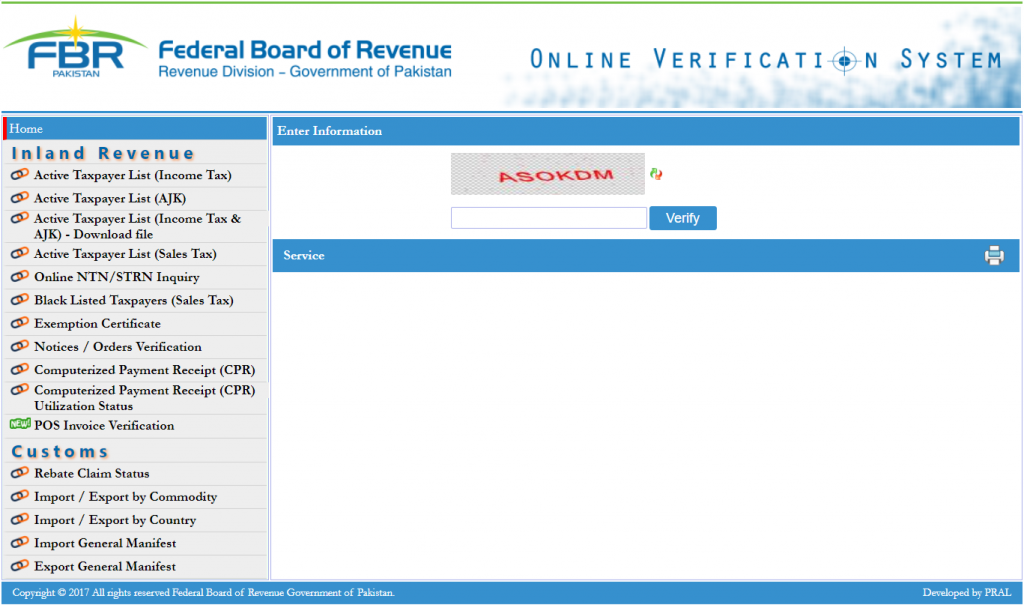

- Head onto FBR Official Website by ——

- On the left-hand toolbar select online NTN/SRTN Inquiry as shown

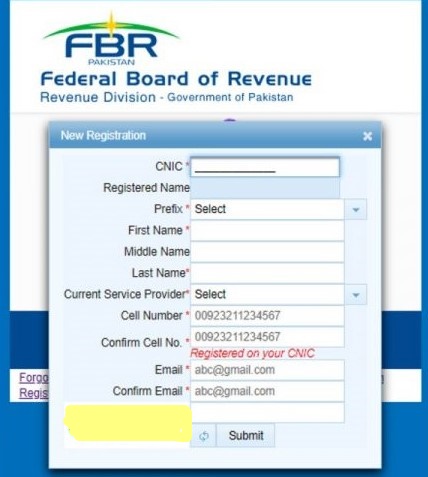

- Enter Your CNIC

- Enter remaining information including your cell number and email address

- By filling the e-form click submit

If you are an active taxpayer all the necessary information will appear on the screen. Otherwise, there will be statements like No data found/ invalid information/ error

The government urges everyone to file their Tax. To maximize tax collection, Govt. has been incentivizing filers through several programs and fee waivers. This is a good trend. To prosper, every citizen must declare his Taxes by becoming a filer. This will generate revenue that will be used in the development and betterment of Pakistan. Find NTN number is so easy.