Here you can get information about the Imported Phones Tax Calculator in Pakistan. Taxation is one of the most common financial terms. Taxes are one of the basic sources of revenue for the government as they complete various projects and programs. They are paid for by central and state governments. Read on to learn about different tax features.

Imported Phones Tax Calculator in Pakistan

Purpose of Tax

Taxation serves many purposes and is essential to our country’s economic development, funding, and development. While tax money is used to accomplish various projects, it is a major source of funding for several important government social programs.

Prices also help to reduce economic inequality in society by redistributing wealth. It helps the government to build roads, schools, health care facilities, and strengthen fiscal law and the justice system.

Classes of Taxes

There are two types of Tax.

Direct Tax: it involves income tax or tax on property or any asset

Indirect Tax: The tax-exempt income and asset on every good you are using. In order to fund public services, tax revenue must be protected in a stable manner and in sufficient quantity. The basic principle is that the amount of money required for public services such as public safety benefits balancing tax liability and social insurance premiums. It is our responsibility to ensure that the luggage will not be passed on to future generations.

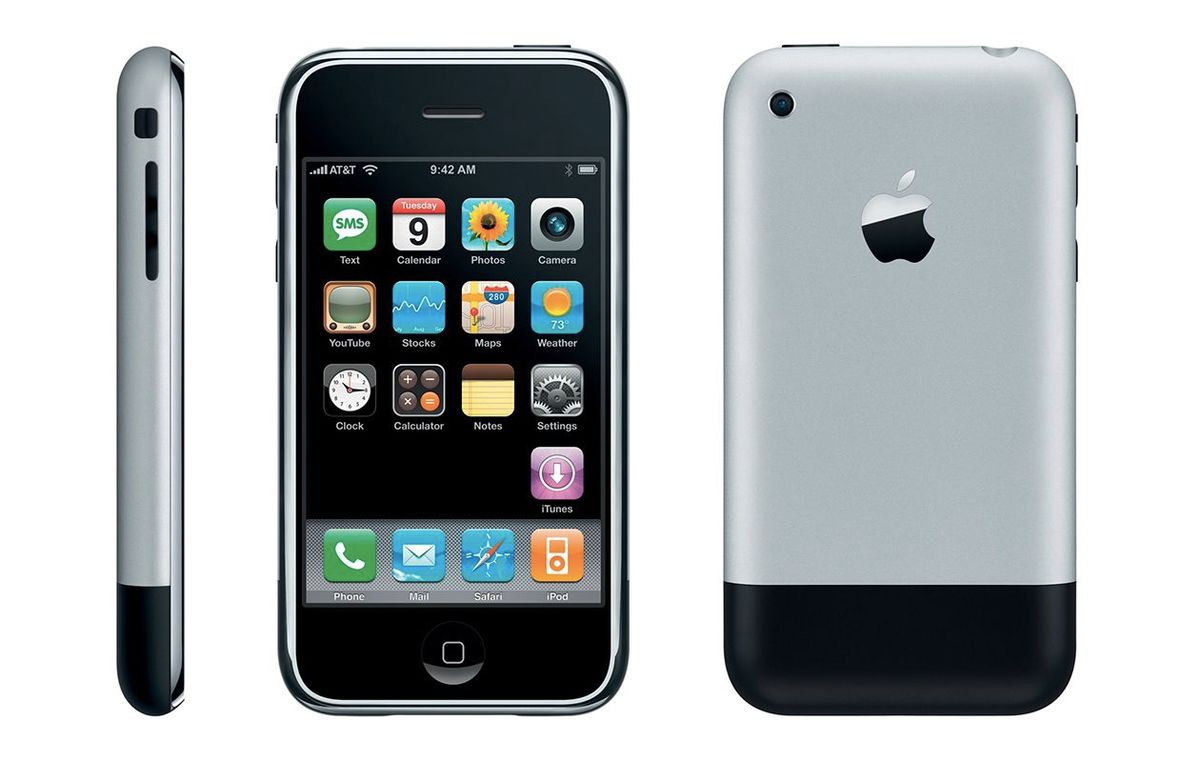

Tax on imported Phones

if someone carries a phone from abroad he must have to pay the tax either it is simple phone, smartphone, or tablet. if someone do not pay tax the mobile phone will not work in Pakistan. The working system is present in Pakistan that identifies non- compliant devices. The system is named of Device identification Registration and blocking System (DIRBS)

List of Tax

The federal board of Revenue (FBR) has released a list to explain the income Tax ordinance through the tax laws. The government has reduced taxes on affordable phones. The idea of collecting tax is for improving everyone’s life.

The Fbr mobile phone list 2020 is a little different from 2019. Govt. has minimized the tax. it is great news for Pakistanis living abroad. Ever filler and non Filler will pay tax must.

for every phone, there is a fixed tax that has to pay to govt. This list will tell you how much tax you have to pay on each cell phone importing from abroad.

Regulatory Duty on Imported Phones

1. Regulatory Duty: it is based on cell phone prices in USD.

$1 to $30 = PKR 180

$30 to $100 = PKR 1800

$100 to $200 = PKR 2700

$200 to $350 = PKR 3600

$350 to $500 = PKR 10500

$500+ = PKR 18500

2. Sales Tax: it will be based on cell phone prices in USD.

$1 to $30 = PKR 150

30 to $100 = PKR 1470

$100 to $200 = PKR 1870

$200 to $350 = PKR 1930

$350 to $500 = PKR 6000

$500+ = PKR 10300

3. Withholding Tax ( WHT )

$1 to $30 = PKR 70

$30 to $100 = PKR xx

$100 to $200 = PKR 930

$200 to $350 = PKR 970

$350 to $500 = PKR 3000

$500+ = PKR 5200

4. IT Duty = 9%

5. Mobile Levy (based on phone prices in PKR)

If the price of the cell phone is PKR 10,000 to 40,000 = mobile levy will be PKR 1000

You need to Know if PKR 40,000 to 80,000 = PKR 3000

Over PKR 80,000 = PKR 5000

6. Provincial Tax = Provincial tax will be 0.9% that will be applied.